Corn isn’t something most restaurant operators talk about when they’re engineering menus or reviewing food costs. But behind every chicken sandwich, pulled-pork plate, and burger patty sits one of the most influential pricing drivers in the foodservice supply chain: livestock feed.

Corn is the cornerstone of U.S. livestock nutrition, and when corn prices swing, protein markets almost always follow. Sometimes the impact happens fast. Other times it plays out over years. Either way, operators eventually feel the effects on purchasing budgets, contractor negotiations, and menu margins.

ArrowStream’s commodities team keeps close watch on corn because of how directly it connects to foodservice risk, from short-term poultry pricing to long-cycle beef supply shifts.

Why Corn Is So Critical to Protein Pricing

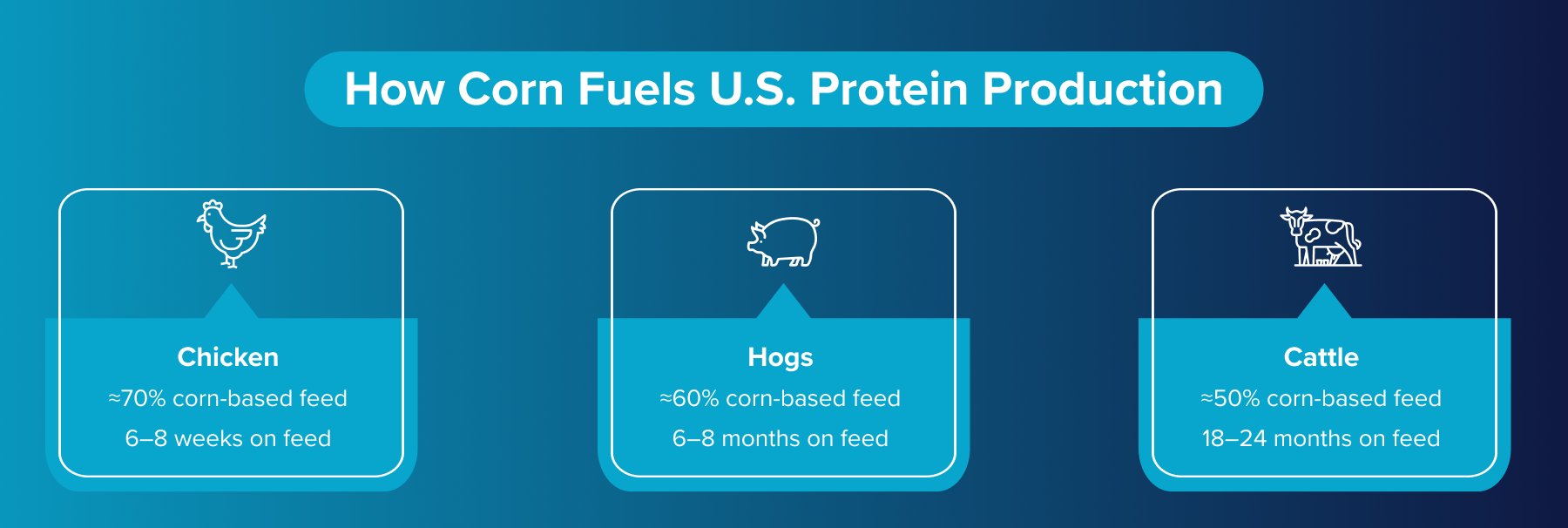

To understand how corn affects protein availability and cost, it helps to know how dominant corn is inside feed rations:

- Chickens: ~70% of feed diets, with birds reaching market weight in just 6–8 weeks

- Hogs: ~60% of feed diets, with animals on feed for 6–8 months

- Cattle: ~50% of feed diets, supplemented by hay, distiller grains (from ethanol production), and other grains with cattle spending a full 18–24 months on feed

As Paul Savage, Director of Commodities at ArrowStream, explains:

“Corn prices are the cornerstone of livestock feed in the U.S. Higher or lower corn prices directly affect both the cost of livestock and how much livestock production or supply will occur in the future.”

That “time on feed” matters. It’s why chicken markets react fastest to corn volatility; pork follows with a delay, and beef lags most significantly but also feels the deepest long-term impact when feed prices stay elevated.

What’s Happening in the Corn Market Right Now

On the surface, corn fundamentals look relatively comfortable.

John Goodwin, Senior Commodity Analyst at ArrowStream, notes that the domestic balance sheet currently appears looser than it has in recent years, driven largely by what’s shaping up to be another record corn crop.

However, several factors are preventing prices from slipping lower:

- The market holds ongoing doubts about the USDA’s optimistic 186 bushel-per-acre yield estimate, keeping prices supported.

- Export demand is exceptionally strong, running at a record pace and on track to exceed the USDA’s projected 3.075 billion bushels for the marketing year.

- As a result, real-world supply dynamics likely differ from what official reports reflect.

In short, supply appears healthy on paper, yet demand is quietly absorbing much of it.

Because of these offsetting pressures, Goodwin expects corn futures to remain relatively rangebound near $4.35 to $4.50 per bushel in the near term. But that calm may not last.

As spring approaches and 2026 planting acreage estimates begin to emerge, markets could see renewed upward momentum.

Adding to the uncertainty, shifts in global trade, particularly the ongoing U.S.–China truce, may encourage increased soybean plantings and lower corn acreage. Any reduction in planted corn has the potential to tighten feed availability in future growing cycles.

Why This Matters for Protein Supply

Corn volatility doesn’t just influence protein prices, it can affect how much protein comes to market at all.

Paul Savage highlights a powerful long-term example:

“When corn prices rose sharply in 2021 and peaked in mid-2022, it triggered the contraction phase of the 10-year cattle cycle.”

That surge in feed costs led ranchers to reduce herd sizes because managing cattle became too expensive. This contraction hit available beef supply beginning in 2023 and is expected to continue well into 2026.

In higher feed-cost environments:

- Ranchers harvest cattle earlier or reduce herd expansion

- Long feeding cycles amplify supply tightness

- Reduced harvest volume causes beef prices to rise

This cycle affects cattle most severely because of the species’ extended feed timeline, but feed inflation still ripples into pork and poultry as producers adjust placements based on profitability.

While corn prices have cooled significantly from their 2022 peak (when prices exceeded $8 per bushel), Savage notes the livestock sector would benefit most if corn returned to below $4 per bushel, where it has historically traded.

Until then, ongoing pricing pressure remains a risk across protein categories.

What Operators Feel on the Ground

While futures markets and acreage forecasts grab analyst attention, operators experience corn volatility in far more practical ways:

- Unstable protein pricing, especially on chicken

- More frequent contract adjustments or escalators

- Availability challenges tied to reduced production placements

- Shrinking menu margins, particularly on high-volume center-of-plate SKUs

And because purchasing teams are juggling staffing shortages, vendor management, forecasting, and financial reporting, few have time to become commodity market experts on the side.

That’s where purchasing risk quietly grows: reacting to price shifts after they happen instead of planning for them ahead of time.

Managing Price Risk With CommodityONE

This is exactly the problem CommodityONE is designed to solve.

CommodityONE enables foodservice operators to manage price risks by pairing commodity forecasting with item-specific food cost modeling, translating corn volatility directly into actionable purchasing strategy.

Operators using CommodityONE can:

- Forecast commodity trends and how they’re likely to drive chicken, pork, and beef pricing before increases hit invoices.

- Model real menu-item cost exposure SKU by SKU, identifying where margins are most vulnerable.

- Plan buy-forward strategies at historically favorable points in the pricing cycle.

- Adjust menu features and promotions, leaning into higher-margin proteins when volatility spikes elsewhere.

- Strengthen supplier negotiations using objective market data not guesswork.

As Paul Savage summarizes:

“CommodityONE enables restaurants to lock in costs at cyclical lows, strategically shift menu features toward higher-margin items, and protect profitability in volatile markets.”

From Reaction to Strategy

Without forecasting and modeling tools, purchasing conversations tend to be reactive:

- “Why did chicken spike again?”

- “Should we lock now or wait?”

- “Are we overpaying compared to the market?”

CommodityONE shifts those conversations into strategy:

- “Which SKUs are most exposed next quarter?”

- “When does feed volatility translate into protein pricing?”

- “How do we protect margins while staying competitive?”

That change, from surprise to preparedness, is how leading brands stabilize food costs while competitors scramble to catch up.

Looking Ahead

Corn markets will continue to swing with weather patterns, export demand, geopolitical shifts, and planting decisions. Protein supply and pricing will follow sometimes quickly, sometimes over multi-year cycles like beef.

The key advantage isn’t predicting markets perfectly, it’s having visibility and modeling tools strong enough to plan intelligently through uncertainty.

With CommodityONE and ArrowStream’s Commodity Intelligence solutions, foodservice operators gain:

- Forward insights into corn and protein pricing trends

- Item-level food cost modeling tied to real menu impact

- Better buy-forward planning

- Data to support informed supplier negotiations and menu strategy

Final Takeaway

Expensive corn doesn’t instantly create shortages, but it consistently introduces pricing volatility and supply planning challenges that operators must manage.

Foodservice brands that navigate these cycles successfully aren’t guessing, they’re pairing commodity forecasting with item-specific food cost modeling to stay ahead of market risk.

That’s exactly where CommodityONE delivers its biggest value: turning volatility into strategy instead of surprise.