Forecasting inventory needs across a distributed restaurant network is one of the most complex responsibilities in foodservice supply chain. On the surface, it’s simply predicting what products will be required and when. In practice, forecasting is shaped by data quality, internal processes, supplier performance, and how well information flows across the network.

Most of the friction doesn’t come from external forces, it comes from inside the organization. Legacy tools, siloed data, inconsistent processes, and limited visibility all create gaps that make inventory replenishment forecasting far more difficult than it needs to be.

This piece explores the internal challenges that complicate replenishment forecasting and why so many organizations are rethinking the systems and structures that support it.

Outdated Tools Make “Good Enough” the Ceiling

A surprising number of restaurant organizations still build replenishment plans using spreadsheets, static ERP reports, or lightly customized tools that weren’t designed for modern supply chain complexity.

This creates a few predictable issues:

- Significant manual work to pull, cleanse, and normalize data

- Slow reaction time when demand patterns shift

- Inconsistent logic and heavy reliance on “gut feel” overrides

- Models that can’t scale as menu complexity or store counts grow

These legacy approaches can only deliver so much. As the business evolves (more SKUs, more distributors, more channels) the forecasting process stretches past its limits. The result is a forecast that tops out at “good enough,” not “reliable.”

Fragmented, Siloed Data Makes Strong Forecasting Nearly Impossible

Strong inventory replenishment forecasting depends on accurate, connected data, but even the most sophisticated logic can’t overcome fragmented systems and poor data quality.

In many organizations, sales data, distributor data, purchasing data, and inventory levels all live in separate systems, each updated on different cadences and formats. This fragmentation creates challenges such as:

- Forecasts built on incomplete or stale information

- Difficulty understanding true usage by SKU, region, or distributor

- Inconsistent item codes, pack sizes, and master data

- Analysts spending more time reconciling spreadsheets than refining forecasts

This is also where SKU rationalization and consolidated spend visibility become essential. If a supply chain team struggles to answer basic questions like “What exactly are we buying, and from whom?” forecasting becomes guesswork.

Limited Inventory Visibility Forces Reactive, Not Strategic, Planning

A forecast depends not only on demand signals but also on a clear picture of what’s already in the system. Limited inventory visibility is one of the biggest barriers to effective inventory replenishment forecasting, especially when teams rely on delayed or incomplete snapshots of inventory data.

Many organizations still rely on periodic snapshots rather than real-time or near-real-time inventory visibility. That means:

- DC inventory may only be reviewed weekly

- Location inventory may only be reported monthly

- In-transit product often sits in a separate system or report

- Usage trends are spotted long after patterns begin

With delayed visibility, planners spend more time reacting to surprises than preventing them. Stockouts surface late. Overages go unnoticed. Opportunities to shift inventory or adjust orders are missed.

Modern visibility, consolidated, clean, and refreshed continuously, gives planners lead time to stay ahead instead of scrambling behind.

Misaligned Stakeholders Create Conflicting Signals

Forecasting affects many teams in the company:

- Supply Chain Planning

- Purchasing

- Operations

- Finance

- Distributors and Suppliers

When these stakeholders don’t agree on the same ideas, the forecast signal gets broken up.

Some common signs are:

- Distributors were surprised by sudden increases or decreases in orders.

- Plans for the company don’t match up with how they actually restock.

- There are different “versions of the truth” going around the company.

- Not sure if failures are caused by forecasting, buying, or carrying out plans

To make a successful replenishment plan, everyone in the chain needs to agree on demand, constraints, and timing, not just have good math skills.

Communication Gaps Slow Down Response Time

If information doesn’t move quickly across the network, even a good forecasting process can go off track.

Some common places where things get stuck:

- Forward demand does not include LTOs, menu changes, or promotional lifts.

- Supplier lead time changes communicated too late

- Substitutions, allocation events, or shorted deliveries not visible upstream

- Internal teams only find out about limits after orders have been placed.

This makes it harder to change course. For a modern forecasting environment to work, communication needs to be predictable and consistent. There shouldn’t be any ad-hoc conversations or updates after the fact. To keep plans in sync, a lot of companies are now focusing on shared dashboards, review cycles that involve people from different departments, and better collaboration between distributors and vendors.

Supplier Coordination Adds Another Layer of Complexity

The plan doesn’t end when the forecast is made. Suppliers and distributors need enough time and information to help with that plan.

Internal coordination challenges often include:

- Not enough sharing of volume expectations for the future

- Misalignment between restaurant order cycles and supplier production schedules

- Minimum order amounts that don’t match demand

- Not being able to see what suppliers can and can’t do

- Limited planning for risks like disruptions or shortages

When suppliers are included in conversations about forecasting earlier, with better data and clearer expectations, replenishment becomes smoother, more predictable, and less reliant on last-minute adjustments.

Skills, Bandwidth, and Process Gaps Hold Teams Back

Forecasting is still a people-driven field, even with advanced technology. A lot of supply chain teams work with a small number of people, doing forecasting, contracting, pricing, RFPs, logistics, and solving problems on a daily basis.

Because of this, forecasting problems often come from:

- Not enough analytical tools to improve or check models

- Different concepts or regions use forecasting processes in different ways

- There are gaps in training when new systems are put in place

- Different teams changing their forecasts in different tools

These problems get worse. Forecasting norms change when there is no clear ownership. Data quality suffers when processes aren’t standardized. Adoption slows down without ongoing training. And the team stays in firefighting mode because they don’t have enough bandwidth, which doesn’t leave much time for strategic improvement.

Why Traditional Approaches Struggle to Keep Up

When outdated tools, siloed data, limited visibility, and misaligned teams collide, inventory replenishment forecasting struggles to keep pace with the realities of modern restaurant supply chains.

- Forecast accuracy reaches a ceiling

- Teams rely heavily on safety stock and buffers

- Distributors face avoidable service challenges

- Fire drills become part of the weekly routine

- Waste and excess inventory quietly creep up

Most organizations already picked the “low-hanging fruit” in forecasting years ago. The next level of improvement requires reducing the internal friction that clouds demand signals and slows decision-making.

The Shift Toward Predictive, AI-Driven Forecasting

As restaurant networks scale and as purchasing and supply chain functions mature, more teams are adopting forecasting models built for today’s complexity.

Some of the most meaningful shifts include:

Forecasting at the item-by-distributor level

Patterns vary by supplier, region, and distribution partner. More granular modeling improves accuracy where it matters most.

Automated data preparation and cleansing

Removing incomplete or outdated records automatically helps ensure forecasts start with clean inputs, not manual patchwork.

Prioritizing high-impact SKUs

Focusing the most advanced modeling on the top spend and volume items helps protect the products that drive financial performance.

Continuous model retraining

Instead of static logic, modern forecasting tools refresh daily or weekly aligning predictions with emerging trends, seasonality, and real usage.

Across the industry, these approaches are becoming core to how supply chain and purchasing teams strengthen buying decisions, minimize surprises, and better anticipate demand.

The point isn’t the algorithm, it’s the clarity. When clean data, timely insights, and intelligent models come together, forecasting becomes less reactive and more strategic.

The Path to More Confident Forecasting

Inventory replenishment forecasting will never be effortless, especially in a multi-unit restaurant environment where demand shifts quickly and supply networks span dozens of partners.

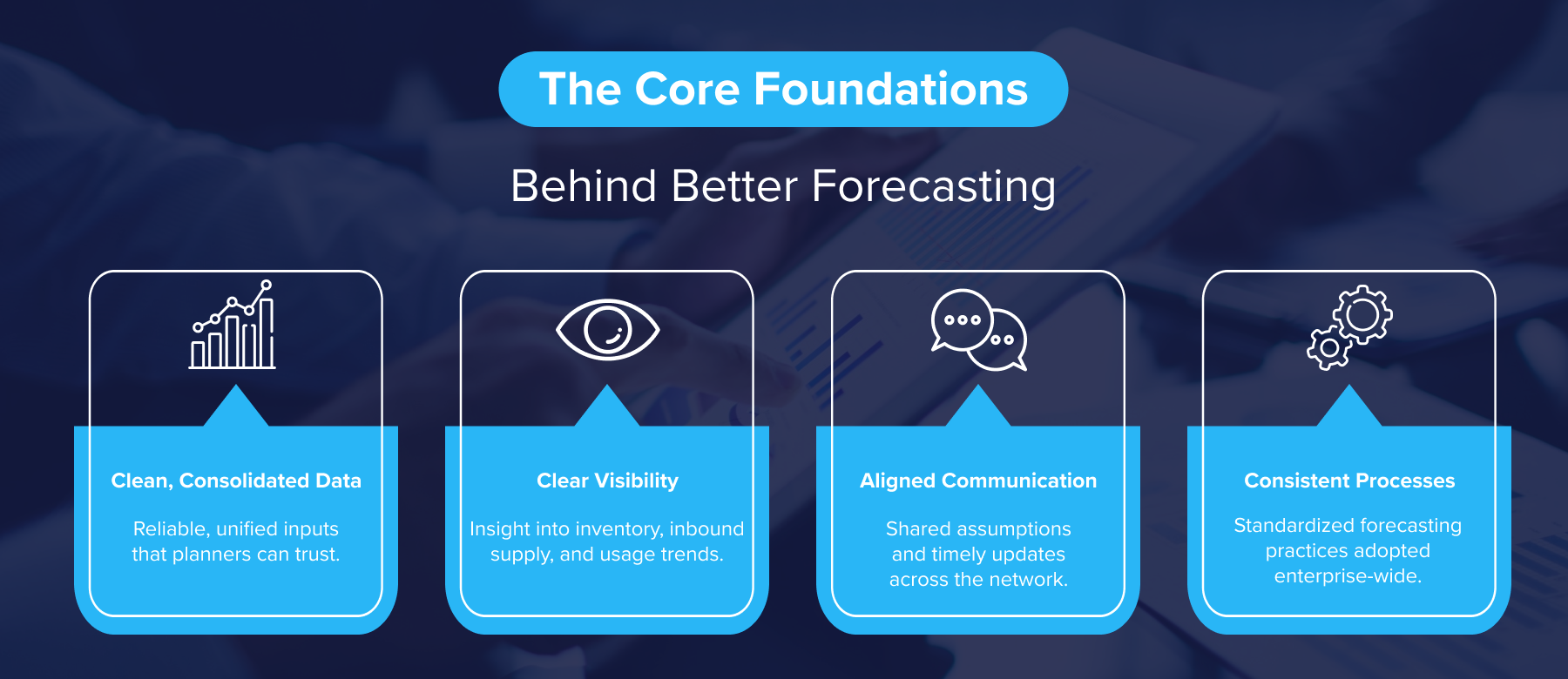

They invest in clean, consolidated, trustworthy data so planners aren’t forced to stitch together their own version of the truth. They build clear visibility into inventory, inbound supply, and item performance so surprises surface earlier. And, they establish predictable communication rhythms across internal teams and distribution partners. And they reinforce standardized processes so forecasting isn’t reinvented region by region, tool by tool, or person by person.

Once those foundations are in place, more advanced modeling, including AI-driven predictions, can create meaningful lift. Instead of relying on broad trends or weekly snapshots, teams gain sharper item-level insight, earlier warnings on potential run-outs, and a more accurate view of how upcoming demand may move.

For many restaurant supply chain and purchasing leaders, the real goal isn’t a perfect forecast, it’s a more confident one. A forecast supported by clean data, consistent processes, and timely intelligence is easier to trust, easier to act on, and far more effective at protecting service levels and food costs.

This is where platforms built specifically for foodservice play an increasingly important role. By consolidating data, improving visibility, and supporting more proactive planning, solutions like ArrowStream help teams strengthen the forecasting foundation that everything else relies on, enabling them to move from reactive firefighting to strategic decision-making with far greater confidence.